WHAT CREDIT SCORE IS NEEDED TO BUY A HOUSE IN NEW YORK?

Michelle Zambrano | January 11, 2021

There’s no need to stress out biting your nails while you wait to learn if you’re approved for a mortgage or not.

It’s simple. The minimum credit score needed to buy a house in New York depends on the mortgage program.

The 3 most common mortgage programs are:

How Credit Scores Affect Your Payments

Your scores tell the bank how likely you are to miss a payment.

Lower scores means a greater risk to the bank. The result is you pay a higher interest rate.

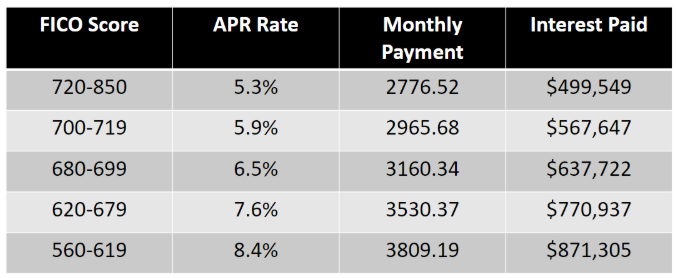

How much more? Check out this graphic:

These are not today’s interest rates. This is just an example to illustrate the effect your credit has on your monthly payment.

You can clearly see the potential savings you stand to realize when you take measures to make sure your scores are as high as possible before applying for a loan.

While you can qualify for a loan with a 620 score, (in this example) you’ll spend $270,000 more on interest payments over the life of the loan.

That money could easily fund your retirement account, the 529 plan for your children’s college education, a new car, or even a second home!

How Your Credit Scores Are Calculated

There are 5 factors that determine your credit scores.

Get Your Credit Mortgage Ready

There are several steps you can take to improve your credit scores before you apply for financing.

Follow these steps to reduce your interest payments and save money for the future.

Apply for Down Payment Assistance

Once you've obtained your mortgage pre-approval, the next step is to apply for down payment assistance.

There are a number of grants and loan programs available to home buyers that need help with their payment and closing costs.

Simply click the button below to find out if you qualify.

There is no credit check and no credit card is required.

You are not under any obligation to buy anything at any time.